- Order By:

- All | Freeware<< Records 1-20 | Go to1Next >>page

DEADLINES FOR FILING W-2 AND 1099 FORMS W-2: ALL W-2 filings, both paper and electronic filings must be submitted by January 31st, 2020. 1099-MISC: The e-file and paper filing deadline of January 31st, 2020 FOR 1099-MISC ONLY IF YOU ARE REPORTING NON-EMPLOYEE COMPENSATION. All other paper filers still have a February 28, 2020 deadline.

More InfoDownload

- Platforms: Windows

- Similar:1099 Printing , Accounting , Accounting Software , Check Writing , Free Check Printing Software , Free Payroll Software , Payroll , Payroll Application , Payroll Program , Payroll Software

- License: Shareware

- Cost: $59.00 USD

- Size: 1.6 MB

Payroll Mate is easy to use, yet powerful software for payroll.

More InfoDownload

- Platforms: Windows

- Similar:2010 Payroll Software , Hr Payroll Software , Payroll Accounting Software , Payroll Deduction Software , Payroll Program , Payroll Software , Payroll Software Program , Payroll Solutions , Payroll System , Payroll Tax Software

- License: Demo

- Cost: $99.00 USD

- Size: 6.9 MB

1099 Software for preparing, printing and E-filing 1099 forms and W2 Forms.

More InfoDownload

- Platforms: Windows

- Similar:1099 Forms , 1099 Forms Software , 1099 Software , Hr Payroll Software , Illinois Sales Tax Software , Payroll Program , Payroll Software , Payroll Software Program , Print Check , Small Business Payroll Software

- License: Shareware

- Cost: $39.00 USD

- Size: 2.2 MB

PayrollSoftware Calculates withholding tax for you or a small business payroll. Print pay checks and year to date report. Accounting USA only.

More InfoDownload

- Platforms: Windows

- Similar:Accounting , Check , Checks , Earn , Employee , Employer , Irs , Ledger , Manage , Pay

- License: Shareware

- Cost: $24.95 USD

- Size: 6.5 MB

PayrollSoftware Calculates withholding tax for you or a small business payroll. Print pay checks and year to date report. Accounting USA only.

More InfoDownload

- Platforms: Windows

- Similar:Accounting , Business , Check , Checks , Employee , Employer , Irs , Manage , Pay , Paycheck

- License: Shareware

- Cost: $24.95 USD

- Size: 8.2 MB

Payrollsoftware for small companies with simple payroll needs.

More InfoDownload

- Platforms: Windows

- Similar:Accounting Software , Direct Deposit , Employee , Employee Payroll , Free Payroll Software , Human Resources , Income , Medium Business , Payroll , Payroll Calculator

- License: Shareware

- Cost: $149.00 USD

- Size: 45.2 MB

PayrollSoftware Calculates withholding tax for you or a small business payroll. Print pay checks and year to date report. Accounting USA only. small business

More InfoDownload

- Platforms: Windows

- Similar:Accounting , Business , Check , Checks , Employee , Employer , Irs , Manage , Pay , Paycheck

- License: Shareware

- Cost: $24.95 USD

- Size: 8.2 MB

PayrollSoftware Calculates withholding tax for you or a small business payroll. Print pay checks and year to date report. Accounting USA only. small business

More InfoDownload

- Platforms: Windows

- Similar:Accounting , Business , Check , Checks , Employee , Employer , Irs , Manage , Pay , Paycheck

- License: Shareware

- Cost: $24.95 USD

- Size: 8.2 MB

AttendHRM is a complete payrollsoftware with TDS for small to large organizations that automates all your payroll processes. Configure your payroll rules, and leave the rest to AttendHRM, it saves you lots of time spend fixing your payroll issues.

More InfoDownload

- Platforms: Windows

- Similar:

- License: Commercial

- Cost: $149.00 USD

- Size: 37.2 MB

PayrollSoftware Calculates withholding tax for you or a small business payroll. Print pay checks and year to date report. Accounting USA only. small business

More InfoDownload

- Platforms: Windows

- Similar:Accounting , Business , Check , Checks , Employee , Employer , Irs , Manage , Pay , Paycheck

- License: Shareware

- Cost: $24.95 USD

- Size: 8 B

HRSoftware with integrated Time Attendance, Leave and Payroll. Includes Employee Scheduling, Leave, Overtime, Shift Management. Supports multiple companies and locations.

More InfoDownload

- Platforms: Windows

- Similar:Hr Software , Leave Management , Overtime Software , Payroll Software , Time Attendance

- License: Freeware

- Cost: $0.00 USD

- Size: 37.2 MB

HRSoftware with integrated Time Attendance, Leave and Payroll. Includes Employee Scheduling, Leave, Overtime, Shift Management. Supports multiple companies and locations.

More InfoDownload

- Platforms: Windows

- Similar:Hr Software , Leave Management , Overtime Software , Payroll Software , Time Attendance

- License: Freeware

- Cost: $0.00 USD

- Size: 41.9 MB

W2 Mate is a W2 printing, 1099 printing, W2 E-FILE and 1099 E-File software.

More InfoDownload

- Platforms: Windows

- Similar:1099 Forms , 1099 Software , 2010 1099 Forms , 2010 1099 Int , 2010 1099 Misc , 2010 1099 Software , 2010 1099-div , 2010 1099-r , 2010 W2 1099 Software , 2010 W2 Software

- License: Shareware

- Cost: $39.00 USD

- Size: 4.7 MB

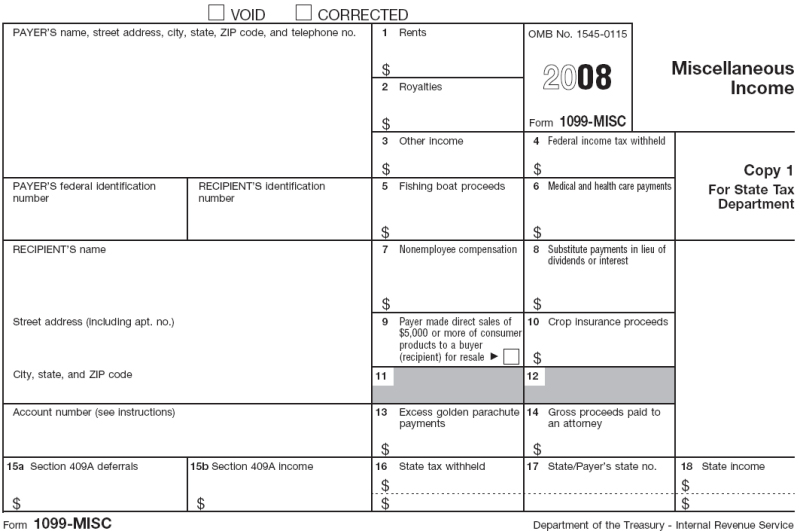

1099 MISC Software to print and efile 1099 MISC Forms.

More InfoDownload

- Platforms: Windows

- Similar:1099 Forms , 1099 Misc Software , 1099 Software , Form 1099 Misc Software , Hr Payroll Software , Illinois Sales Tax Software , Payroll Program , Payroll Software , Payroll Software Program , Print Check

- License: Shareware

- Cost: $39.00 USD

- Size: 4.4 MB

W2 Mate is 1099 Forms Software used to import, process, prepare, e-mail and e-file IRS 1099 forms and W2 Forms.

More InfoDownload

- Platforms: Windows

- Similar:1099 Forms , 1099 Software , 2010 1099 Int , 2010 1099 Misc , 2010 1099 Printing Software , 2010 1099 Software , 2010 1099 Tax Software , 2010 1099-div , 2010 1099-r , 2010 W2 1099 Software

- License: Shareware

- Cost: $39.00 USD

- Size: 4.7 MB

W2 Mate is the easiest and fastest W2 and 1099 Forms printing software.

More InfoDownload

- Platforms: Windows

- Similar:1099 Forms , 1099 Software , File W2 , Hr Payroll Software , Illinois Sales Tax Software , Payroll Program , Payroll Software , Payroll Software Program , Print 1099 , Print Check

- License: Shareware

- Cost: $39.00 USD

- Size: 960.0 KB

W2 Mate is a 1099 software for Printing / E-filing 1099-MISC forms, 1099-INT forms, 1099-DIV forms, 1099-R forms, W2 forms, 1096 and W-3 transmittals.

More InfoDownload

- Platforms: Windows

- Similar:1099 E-file Software , 1099 Filing , 1099 Forms , 1099 Forms Software , 1099 Misc Software , 1099 Printing Software , 1099 Software , 1099 Tax Software , Efile 1099 Misc , Hr Payroll Software

- License: Shareware

- Cost: $39.00 USD

- Size: 4.7 MB

ResumeGrabber Pro is a resume extraction software that imports resumes from search engines, job boards and transfers them to your database.

More InfoDownload

- Platforms: Windows

- Similar:B2b Lead Generation Software , Business Lead Generation Tool , Capture Cv , Data Capture Software , Email Lead Generation Software , Email List Completion Tool , Hr Recruiting Tools , Hr Recruitment Software , Lead Capture Software , List Building Software

- License: Shareware

- Cost: $495.00 USD

- Size: 28.2 MB

W2 Mate is a useful software

for filling out, editing, saving and printing W2, 1099-MISC, W3, and 1096 forms.

for filling out, editing, saving and printing W2, 1099-MISC, W3, and 1096 forms. More InfoDownload

- Platforms: Windows

- Similar:1099 Forms , 1099 Software , Edit Form , Editor , Filler , Form , Hr Payroll Software , Illinois Sales Tax Software , Payroll Program , Payroll Software

- License: Demo

- Cost: $39.00 USD

- Size: 4.7 MB

W2 Mate is a useful software for filling out, editing, saving and printing W2, 1099-MISC, W3, and 1096 forms.

File 1099 Misc For Free

More InfoDownload- Platforms: Windows

- Similar:1099 Forms , 1099 Software , Edit Form , Editor , Filler , Form , Hr Payroll Software , Illinois Sales Tax Software , Payroll Program , Payroll Software

- License: Demo

- Cost: $39.00 USD

- Size: 4.7 MB

Do you know what your payroll is costing you? Why pay $200 a month to a payroll service company when you can spend only $119 a year (no monthly fees) for all your payroll needs? Payroll Mate® is a comprehensive payroll software that fits the needs of accountants, small to medium size businesses (SMBs), agricultural employers, non-profits, local governments, schools, household employers and the self-employed. Payroll Mate not only offers solid return on investment, but also gives employers better control over payroll-related activities, provides easier access to employee / wage information, simplifies reporting / compliance / record-keeping and helps employers address employee information confidentiality concerns.

Payroll Mate 2020 automatically calculates net pay, federal withholding tax, Social Security tax, Medicare, state and local payroll taxes. Payroll Mate also supports different types of payroll pay periods, prints checks, prepares payroll forms 941, 943, 944, 940, W2 and W3. This software also supports user-defined Income, Tax, and Pre-tax / Post-tax Deduction categories making it very flexible and powerful. Our payroll system works with different accounting software including Intuit QuickBooks, Sage Peachtree (Sage 50), Quicken, Microsoft Accounting and more.

Payroll Mate Detailed Feature List

Last updated: June 30, 2020

Software To Print 1099 Misc

- Automatically calculates federal and state payroll taxes. Our software comes with a built-in payroll and paycheck calculator for federal withholding and state withholding for all 50 states and District of Columbia. Tax tables and payroll formulas are updated throughout the year and pushed via the touch-free auto-update mechanism.

- Multiple Pay Frequencies (Payroll Cycle Duration). Supports different types of pay periods including weekly payroll, biweekly payroll, semimonthly payroll and monthly payroll. Although Payroll Mate gives users the ability to use any pay frequency they want, we recommend extending the duration of payroll cycles to reduce payroll staff's payroll processing activities and thus save time and money.

- One step backup and restore. Make sure you back up your payroll data into a portable device like a flash drive or something similar and keep it in a safe and handy place. Our payroll accounting software reminds the user to back up the company data each time the software is closed. Maintaining regular backups is one of the essentials that employers and payroll processors should never overlook. Offsite storage of payroll information backups is also highly recommend.

- Multiple Pay Types. Our payroll tax software supports regular salary, hourly pay, overtime pay, double overtime, bonus pay and commissions.

- Supports the following federal quarterly and annual payroll forms (ready to sign and send): 941, 940, 943, 944, W-2 and W-3. Our 2020 payroll program makes generating and printing these federal payroll forms as easy as clicking a button. Form 941 is Employer's Quarterly Federal Tax Return. Form 943 is Employer's Annual Federal Tax Return for Agricultural Employees. Form 940 is Employer's Annual Federal Unemployment (FUTA) Tax Return. Payroll Form W-2 is Wage and Tax Statement. Form 944 is Employer's Annual Federal Tax Return and form W-3 is Transmittal of Wage and Tax Statements.

- Includes comprehensive payroll reports : Journal Summary, Journal Detail, Tax Liability, Deposit Requirement, Employee Earnings, Employee List, Payroll Totals, Payroll Detail, Taxes & Deductions, State Taxes and Pay Periods report. Employee Earnings report is ideal for exporting data to HR software and specialized human resources / businesses management applications such as church, farm, trucking and restaurant accounting software. The most comprehensive way for exporting data is of course the general ledger module. One of the crucial reports is the 'Deposit Requirements Report', which shows how much an employer needs to deposit for each tax including form 941 taxes (FICA + Fed WH) that get typically deposited through EFTPS (www.eftps.gov).

- Exports payroll reports to Microsoft Excel, CSV and Adobe PDF. Once a report is generated inside Payroll Mate 2020, the user has a full list of options to export the report data, some of these options include PDF, Text, CSV(Comma Separated Value), MHT, Excel, Rich Text, JPEG, BMP, GIF, TIFF and EMF. This feature is very important in many cases including third-party remittance processing (sending payments to a tax agency or 401K provider).

- Payroll vacation accrual and sick pay accrual (vacation and sick time calculation and tracking). Payroll Mate can track and accrue two types of leave hours: Vacation and Sick. The user has the ability to configure vacation hours earned per check, maximum vacation hours earned per year, sick hours earned per check and maximum sick hours earned per year. When creating a new payroll check, the software automatically calculates vacation hours earned, sick hours earned, vacation hours used and sick hours used (the user has the ability to override any of these values). When printing paychecks, the user has the ability to specify whether vacation and sick time information gets included on the paystub / payslip. The payroll system also comes with a powerful report which lists for each check (in a certain pay period) vacation hours earned, vacation hours used, sick hours earned, and sick hours used.

- Exports Payroll Data to QuickBooks accounting software and Sage 50 (Sage Peachtree). This feature makes Payroll Mate a great alternative to QuickBooks payroll service and Sage payroll.

- Vendor and 1099 Center (software for accounts payable / contractors). Pay 1099 employees / contractors, track vendor checks, generate comprehensive reports and print IRS tax forms 1099-MISC / 1096. Learn more about Vendor and 1099 Center. This feature requires Payroll Mate Option #6 - Additional Fee.

- Prints signature ready checks and extensive pay stubs for your employees.

- Exports Payroll checks to Quicken QIF format.

- General Ledger Export (Posting to Accounting). Exports Payroll Data to GL (General Ledger) for import into accounting / CRM software like Microsoft Office Accounting, Intacct and Oracle's Human Resources Management system. The General Ledger export feature available in our payroll tax software is one of the most advanced and powerful in the industry.

- Supports a number of state payroll forms. Forms currently supported are California DE 9 (Quarterly Contribution Return and Report of Wages), California DE 9C (Quarterly Contribution Return and Report of Wages -Continuation), Texas C-3 (Employer's Quarterly Report ), Texas C-4 (Employer's Quarterly Report Continuation Sheet), New York NYS-45 (Employer's Quarterly Tax and Wage Report ), Florida Reemployment Tax RT-6 (Electronic Reporting of Florida Department of Revenue Employer's Quarterly Report), Illinois 941, Illinois IDES Employer Monthly Reporting and Illinois UI-3/40. (Requires Payroll Mate Option #5 (Additional Charge).

- Access Restriction to Sensitive Payroll Information. Payroll Mate helps employers keep payroll information confidential by offering password protection (users need to input a password to access the system) and offering the ability to mask / hide employees' social security numbers on paystubs. This feature is very important since most employees would be very upset if their incomes, contributions to retirement plans, their Tax IDs and similar information were accessed by unauthorized individuals.

- FREE updates during the tax year.Touch-free updates through the Internet. Updates can also be installed manually in case the user does not have internet access (user lives in a rural area or company policy does not allow online connectivity).

- Dedicated tutorials website with step by step instructions on how to use and customize the software. Users can browse and search for answers directly from inside Payroll Mate.

- Friendly, helpful, professional and FREE US-based technical support by phone, email and chat.

- Supports customizable income, tax and deduction categories. One of the most powerful features of this payroll management software is the ability to define an unlimited number of custom payroll items to fit the employer's needs. With other payroll solutions you are locked in with the built-in payroll items that ship with the product and even if you have the ability to define custom payroll types, you are limited in the number of items you can define. This feature is very useful for users with advanced payroll processing requirements or payroll service bureau.

- Much faster than online payroll solutions (Payroll in the Cloud)

- Imports employee HR information and payroll setup. Businesses switch to Payroll Mate payroll accounting software every day. This is why Payroll Mate offers a powerful engine for importing payroll setup (configuration) from other applications including market leaders such as Sage 50 (Peachtree), Intuit QuickBooks, Sage DacEasy, Kronos, ADP, Paychex, Oracle's PeopleSoft and more.

- Auto calculates Social Security Taxes and Medicare payroll Taxes.

- Auto calculates FUTA (Federal Unemployment Tax), which is paid by employers only. This tax is reported to the IRS through form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return). Payroll Mate® calculates, tracks and reports FUTA tax on form 940. According to IRS form 940 instructions, the time needed to complete and file this form will vary depending on individual circumstances, but the estimated average time for recordkeeping is 9 hours and 19 minutes, for learning about the law or the form is one hour and 23 minutes and for preparing, copying, assembling, and sending 940 form to the IRS the time needed is one hour and 36 minutes. By using our payroll database software this time is reduced to a few minutes.

- Calculates State Unemployment Tax (SUTA).

- Calculates state disability insurance tax. Very few states maintain disability insurance funds, in order to pay employees who are unable to work due to illness and/or injury. In some cases this tax is paid by the employee only and in other cases by both the employee and employer. The states which impose SDI are New York, California, Hawaii, New Jersey, and Rhode Island.

- Direct Deposit. Prepares NACHA - ACH files for direct deposit payroll processing through a financial institution like a bank (Requires Payroll Mate Option #2 - Additional Fee). By using this feature, our customers have direct deposit payroll software with the ability to process unlimited number of direct deposit transactions.

- Regardless of your business size, Direct Deposit offers great benefits, from cost savings to helping the environment.

- Direct Deposit saves you time and money: According to a calculation of the costs of paper checks vs. Direct Deposit payments, a company with 10 employees can save nearly $900 per year by switching to Direct Deposit.

- Direct Deposit is very easy: Payroll Mate makes direct deposit easy and straightforward. Payroll Mate generates a file (ACH file), which you simply send to the bank to process payments for your employees.

- Direct Deposit reduces the likelihood of fraud: With Direct Deposit there are no checks to be lost or stolen and there is less potential for altered amounts and forged signatures.

- Direct Deposit is a smart way to help the environment.

- Multi-Company Management. Supports 10 companies with up to 75 employees per company. You can purchase Payroll Mate Option #3, which adds support for 100 companies with 1000 employees per company.

- Auto calculates New York City Tax (NYC Tax). New York City charges a personal income tax to City residents. The tax is administered and collected by the New York State Department of Taxation and Finance for the City.

- Supports income per mile, per piece and per bucket.

- Supports Farm Payroll. Our payroll system gives agricultural businesses everything they need to manage payroll for farm / ranch workers and labor contractors. Through Payroll Mate ranchers and farmers can file IRS annual tax form 943, pay workers a salary / per hour/ per piece or custom add any type of payroll income that fits their business model. Through the vendor and 1099 center farm employers can pay contractors and issue them 1099s at the end of the year to stay in compliance with IRS regulations as defined by Publication 51 (Agricultural Employer's Tax Guide).

- Supports employees who work in different areas / positions and get paid accordingly (different jobs and rates on the same check for the same employee). For example in a restaurant establishment when an employee cooks she earns chef wages and when the same employee takes orders and delivers plates to customers she makes server wages.

- Payroll Mate can be deployed in a thin-client / virtual-desktop environment including Citrix and Terminal Services (TS). This feature is important for bigger accounting firms, local governments, educational institutions, banks, hospitals and more. Our system can also be deployed in Microsoft Azure RemoteApp environment, which allows users to access applications in the cloud from a variety of devices and operating systems. Some of our users host Payroll Mate online through providers like Right Networks and InsynQ.

- Handles Form 941 adjustments. Supports coronavirus (COVID-19) form 941 changes related to employment tax credits and other tax relief.

- Ideal for religious organizations, churches and non-profit groups. Supports clergy (pastor) taxable and non-taxable earnings. Supports 'Housing Allowance' and provides the ability to exempt or withhold Social Security and Medicare taxes from a minister's paycheck.

- Ability to add employee notes. Use the Employee Notes field to record additional employee info such as hire date, termination date, job title, supervisor name, evaluation notes, date of last raise, and so on. This field can be found under the employee setup wizard.

- Supports Flexible Spending Accounts. Payroll Mate supports FSA payroll deductions where a certain amount of money is withheld from an employee's pre-tax gross pay and gets stored in a fund dedicated for medical and/or dependent care expenses. Throughout the year, funds get disbursed to participating employees who have documented and approved expenditures.

- Ability to print Paystub (remittance advise) ONLY. This feature is useful if you would like to email paystubs (check stubs) to your employees, hand-write checks and in many other cases. A check stub (remittance advice) typically lists an employee's gross pay, wages, tax deductions, withholdings and net pay.

- A step by step, easy to follow wizard guides you through the company creation process. Each newly created company inside this payroll program is automatically filled with a number of default Income, Tax, and Deduction categories, including federal taxes to save you time and effort.

- Easy to follow wizard guides you through the process of adding new employees and deciding appropriate Incomes, Taxes, and Deductions for each employee along with their values. Please remember as an employer you will need to always verify an employee's authorization to work in the United States by completing USCIS form I-9. Our customers often ask about the criteria for specifying an employee's withholding allowances and filing status. This information must always come from an employee-filled and signed form W-4 (Employee's Withholding Allowance Certificate). Once an employee is added in the payroll system, no changes to his or her tax setup /deductions should be applied without a signed request for the payroll department to do so.

- Displays the existing employees in the company in a very clear organized tabular view, with the ability to sort the employees on their names, social security numbers, or any other column in the employees table. Through the employees table, you can easily create new payroll checks or view already created ones for any employee.

- Offers a categorized view of your checks, with the ability to: Group Checks according to employee or pay period; Filter checks to see only the ones of the current month, quarter, year, or even last year(s); Navigate between checks easily while showing you a separate and appealing preview of each check. Previews of paychecks and pay slips are very important to allow employers go over the payroll transactions and make any desired adjustments before actually printing the checks and finalizing the payroll run.

- Makes creating checks easier than you have ever imagined by: Combining all what you need to create a new check or edit an existing one in a single well organized window, instead of going through several tedious windows like other payroll applications. Allowing you to run through the employees' list spontaneously and get each one's incomes, taxes and deductions ready for you to edit. Automatically calculating taxes and deductions and year to date values for current employee as you edit the incomes values!

- Supports Inactive Employees. This feature is very important for employers who hire seasonal and part-time employees.

- Employee payroll may be processed one employee at a time or in batch mode. This includes creating and printing checks/pay slips.

- Retroactive Payroll Processing:Payroll Mate® gives users the ability to apply changes to a specific pay period (or paycheck) after payroll processing is complete for that period. This is very important in cases when an employee gets a retroactive pay adjustment or other payroll appointment.

- Payroll Mate is not hosted or online software. You download the software to your own machine / network where you can setup your employees and run your payroll. No one can take care of your business information and protect it as much as you would. Here's what some of our customers tell us: 'We use Payroll Mate® specifically because it is a desktop app and not a cloud solution. We don't like the cloud. We want a stand-alone package where we don't have to rely on the internet.'

- Supports payroll fringe benefits. A fringe benefit is a form of pay for the performance of services. For example, you provide an employee with a fringe benefit when you allow the employee to use a business vehicle to commute to and from work. Fringe benefits are defined by IRS Publication 15-B (Employer's Tax Guide to Fringe Benefits). Payroll Mate® allows employers and small businesses to custom define various types of fringe benefits such as educational assistance, group-term life insurance coverage, health savings accounts (HSAs) , meals and moving expense reimbursements.

- Supports Schedule A of Form 940 (Multi-State Employer and Credit Reduction Information). This feature is useful for employers who pay wages in a state that is designated by the Department of Labor as 'Credit Reduction State'. Through Payroll Mate, users can easily prepare, review and print 940 Schedule A. Our software auto-populates the schedule based on the payroll checks entered by the user for the year, taking into consideration which states have a 'credit reduction rate' greater than zero. Many computerized payroll systems do not include this feature, although they prepare Form 940 itself, which forces employers to download and manually prepare the schedule at year end. The Department of Labor determines the credit reduction states for each year around end of October / early November.

- Supports Form 943-A (Agricultural Employer's Record of Federal Tax Liability). In addition to supporting form 943, our payroll system supports Form 943-A, which is generally used by agricultural employers who deposit federal income tax withheld and S.S and Medicare taxes on a semi-weekly schedule, or whose tax liability on any day is $100,000 or more.

- Calculates user-defined local payroll withholding tax. Examples of local payroll taxes that can be calculated using Payroll Mate® are city payroll tax, school district payroll tax,municipal income tax, occupational license fees, metropolitan commuter transportation mobility tax, and county payroll taxes.

- Prints on preprinted red-ink laser W2 forms and W3 forms. Employers must file Form W-2 for wages paid to each employee from whom: Income, social security, or Medicare tax was withheld or Income tax would have been withheld if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on Form W-4, Employee's Withholding Allowance Certificate.

- Eliminates the need for buying Forms W2 Copy A and W3 by printing government-approved laser substitutes for these forms on plain white paper (Requires Payroll Mate Option #1 - Additional Fee). Our payroll processing software is approved by the Social Security Administration to print replacements for expensive W2 Forms Copy A and W3 form on regular white paper.

- Runs over a network.

- Very easy to use, saves you precious time and money and designed to minimize data entry / monitoring work for employers and payroll departments.

- W2 and 1099 Electronic Filing: Exports W2 and 1099 data to our W2 Mate W2 / 1099 software, which opens a whole world of features such as federal W-2 electronic filing, state W-2 electronic filing, 1099 electronic filing with the IRS FIRE System, pressure seal and 4-up W2 forms, ability to batch email W-2 forms and much more.

- Handles Cafeteria Plans.

- Supports wage garnishments where the employer is required to withhold a certain amount of an employee's income and forward it to a third party. Examples of garnishments include child support (the most common type and usually has highest priority), student loan garnishment (typically ordered by the Department of Education), federal income tax levy (ordered by the IRS by sending form 668-W) and county tax garnishments. Unlike other payroll systems, Payroll Mate supports multiple wage garnishments for the same employee at the same time. Employers can also use the employee notes field inside Payroll Mate to track garnishment orders and receipt dates, which is very useful for larger companies.

- Supports unique types of wages such as prizes/awards, Christmas gifts, back-pay awards, makeup pay for jury duty, and moving expense reimbursements.

- Reviews: received great reviews from independent sources such as Download.Com, CPA Practice Advisor, and AccountingWEB.

- Help file and online FAQ pages. Payroll Mate - payroll processing software- comes with a built-in help utility and links to the product's support website, which includes a broad FAQ section, tips and knowledgebase.

- Prints on Laser and Inkjet checks.

- Supports additional tax withholding including state and federal.

- Allows user to manually enter payroll checks and includes check register report which is very useful for bank reconciliation.

- Auto calculates employer contribution to retirement plans.

- Tracks Employee name, address and other payroll information.

- Ability to print MICR checks on blank check stock (Requires Payroll Mate Option #4 - Additional Fee)

- Handles payroll deductions that are exempt from federal and state taxes like 401K retirement plans.

- Accountants and payroll processors can use Payroll Mate to prepare payroll for their clients from the comfort of their office, print payroll checks for their clients using the PDF built in capability then email those PDF checks to clients where they can load the printer with the pre-printed Payroll Mate compatible checks and print them in seconds. No need to pay for shipping or wait a day or more for checks to arrive.

Employers and tax professionals looking for ACA 1095-C and 1094-C processing capabilities can utilize our 1095 Mate software, which can handle both paper and electronic ACA reporting. Please contact us for more details (please remember that 1095-C reporting is mainly needed by employers with 50 or more full time employees). Employee data can be easily exported from Payroll Mate (the payroll system) to 1095 Mate (the 1095-C / 1094-C system).

- Employers can process payrolls for the next year without closing off the current year. Payroll Mate has a separate installation and data store for each year, which makes working on payrolls for separate years at the same time easy and safe. When you start a new year, Payroll Mate brings over all the settings and payroll setup from the year before, so you can start processing the new year's payroll in minutes.

- Supports Tips (gratuities) received directly by employee or by employer (this feature is utilized mainly by restaurants).

- Supports the following user-defined payroll items (the user can manually configure these payroll items inside the software): medical insurance , dental insurance , vision insurance , life insurance , S-Corp owners insurance, qualified retirement plan , nonqualified retirement plans , personal retirement accounts , sick or disability pay , business expense reimbursements , club memberships , reduced interest loans , travel time , charitable contributions , child support payments and pay advances deduction.

- Sends payroll reports by email for easier communication between accountants and clients.

- Supports ATF (After the Fact) Payroll. Users of our software for payroll can enter year-to-date totals in easy to follow steps. Some employers for example use Payroll Mate as federal payroll forms software program to generate 941, 940, W2 and W3 after the fact.

- Prints payroll checks with sorting and allows for reprinting selected checks.

- FREE Trial Download, no questions asked!

- Microsoft Windows compatible (for Desktop / Laptop PC) including Windows 10 (different editions), 8.1 (32-bit / 64-bit), Windows 8 (32-bit / 64-bit), Windows 7 32-bit, Windows 7 64-bit, Vista 32-bit, Vista 64-bit and windows XP. Some MAC users run Payroll Mate by utilizing virtualization technologies such as Oracle VirtualBox and Parallels Desktop. Payroll Mate® also runs on Windows tablets (with full Windows OS , not the limited RT version) such as Surface Pro, Lenovo Yoga, Dell Venue Pro, and 2-in-1s (Laptop / Tablet Hybrids).

1099 Misc Program

State Payroll Withholding details: Payroll Mate automatically calculates State Withholding for all 50 states and District of Columbia. Click on the name of your state to learn more.

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida , Georgia , Hawaii , Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan , Mississippi, Missouri, Minnesota, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Comments are closed.